After witnessing the weakest first half in decades, the Indian gold market observed another quarter of inaction. Imports picked slightly in the first two months of the quarter, with a total of 78 tonnes imported, but dwindled again in September when just nine tonnes were shipped to India. Of these 78 tonnes of fresh imports, 55 tonnes were allocated for domestic consumption. Gold demand across the supply chain was notably higher in August as several major manufacturers and retailers re-initiated gold metal loan from banks.

Scrap supply remained relatively strong in the third quarter. There were two main factors at play. Firstly, there has been a rise in distress selling due to the economic slowdown, and secondly, anecdotal evidence confirms people who bought gold during the 'demonetisation' period at an elevated price, were able to take advantage of the record gold price during the quarter to liquidate their previous purchases.

On the other hand, a notable trend since the economy restarted has been that people have been rushing to banks and NBFCs for gold loans. With the rise in the gold price, the loan to value (LTV) ratio has also risen which has therefore helped consumers to get more money on the same volume of gold. We believe banks and NBFCs will continue to benefit from these dual effects of economic slowdown and a high gold price, and hence, their portfolio in this segment will rise exponentially.

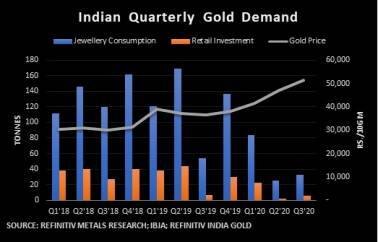

Indian gold jewellery consumption stood at just 33 tonnes in Q3, 38 percent lower than the level seen in 2019 for the same period. Demand trends oscillated quite dramatically in certain pockets of the country depending on quickly the local economies were able to rebound following the lockdowns. Retail investment demand in Q3 was down by 26 percent YoY to 5.2 tonnes. The hefty fall would have been even greater if it were not because of a low base in the previous year.

Demand for sovereign gold bonds (SGB) reached the highest quarter level since the scheme was first introduced in 2015. Reserve Bank of India data reveals 10.5 tonnes were bought in first two months of Q3, while the September number has yet to be made available. The rapid rise in the gold price, restrictions in movement, coupled with fear of moving in public spaces, may be the reason retail buyers have opted to buy gold in the form of SGB from the comfort of their homes.

As of today, Refinitiv India Gold is at Rs 51,550 per 10 gram, lower by 7 percent from the August high. The price has more or less stabilized as the festival season commences. According to market sources, footfall traffic has significantly increased after October 15th and retailers have seen a sharp rise in heavy gold purchases attributed to largely the wedding season. Local spot prices too are trading at a premium of up to $3 an ounce, further cementing the argument that demand is picking up. We believe this trend will continue through the fourth quarter of 2020.

No comments:

Post a Comment